Insuring your business is one of the most important protective measures you can take. Many small business owners rely on business owners policies (BOPs) as an easy way to get coverage. BOPs provide several of the most-necessary business coverage elements in one place. Among their coverage, they will likely include property or possessions insurance. This will provide protection for your business’s hard assets, including most electronics. These are some of the most-important assets to insure, and you will soon find out why.

Yes, you should insure your electronics, but you should also safeguard them. The better you protect these items, the lower your insurance risks might prove.

BOPs and Electronics Coverage

A BOP will contain a few critical elements of insurance for businesses. Among them, policyholders will likely find property insurance. Though property coverage usually applies first to your business’s structure, it will usually cover possessions as well.

Should a mishap damage or destroy business possessions, you might be able to make a property insurance claim to recoup your losses. You can repair or replace items without putting operations or solvency on the line. Among the possessions you might be able to claim are electronics, including:

- Computers and monitors

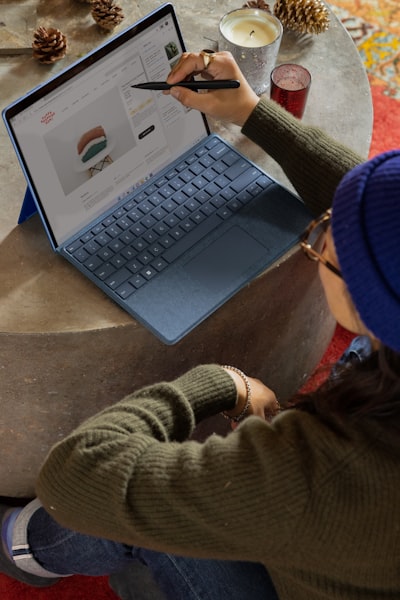

- Tablets

- TVs

- Hard drives and data systems

- Cameras and recording equipment

Work with your agent to get full value coverage for your electronics and data systems. In most cases, BOPs will provide coverage for the replacement cost of the electronics. This means you will be able to buy a new system at the price it would cost you today. Keep in mind, some policies might also pay different total limits for different items. For example, some will place separate limits on computers compared to other items.

Keep in mind, you’ll also want to insure the data within your systems. You’ll likely need:

- Electronic data loss insurance: Coverage can help you recover or replace data lost due to covered incidents. You might be able to make claims after fires, system theft, virus attacks and other hazards.

- Cyber liability coverage: A loss of data, might put your customers in the way of identity theft and other losses. You can use this coverage to pay for data recovery and monitoring services to protect clients' personal security. Coverage might also protect you against lawsuits levied by regulators or clients.

Keep in mind, many BOPs do not automatically include cyber liability insurance. You will likely need to ask your agent to add this coverage to your policy. Let your agent help you choose the coverage limits and protection necessary for your electronics.